37 billion euros of state surplus in the 2025-2026 biennium

According to the European Commission, the Italian economy in the next two years (2025-2026) will grow by 1 percent in the first year and 1.2 percent in the second. Italy's cumulative GDP growth in the two years will thus be about 2.2 percent, the same as that of France and Japan and higher than that of Germany (+2 percent). So, no return to a “tail-end” Italy, as some prophesied, after our country's super growth in the 2020-2024 period (+5.4%, the strongest among the G-7 European countries).

Yet there is an even more important aspect to note. That is, again according to data from the European Commission, Italy has managed to grow during and after the Covid more than many other similar economies despite not having a demographic expansion, on the contrary, with a population decline that is a unique case among the major Eurozone and G-7 countries and that, unfortunately, is destined to persist. However, nevertheless, as we have seen Italy will manage to grow quite well even in the 2025-2026 biennium.

Our per capita GDP growth beats all

It is a fact that in 2025 our population will decline again: precisely by 0.2 percent and in 2026 by 0.3 percent. In contrast, the three other major Eurozone economies (Germany, France and Spain) and the three other major non-EU G-7 economies (the U.S., Japan and the U.K.) will continue to have steady population growth, which in itself will contribute not insignificantly to the growth of their economies. Spain's population, for example, will increase by 1 percent in 2025 and 0.8 percent in 2026; those of the United States and the United Kingdom, respectively, by 0.8 percent and 0.7 percent in both years.

Of course, a population decline is not a positive element, especially in the long-term perspective. But, from another angle, being able to grow GDP despite a sharp decline in population is like winning a nine-man soccer game or a boxing match with one hand tied behind your back. And Italy's “miracle” lies precisely here.

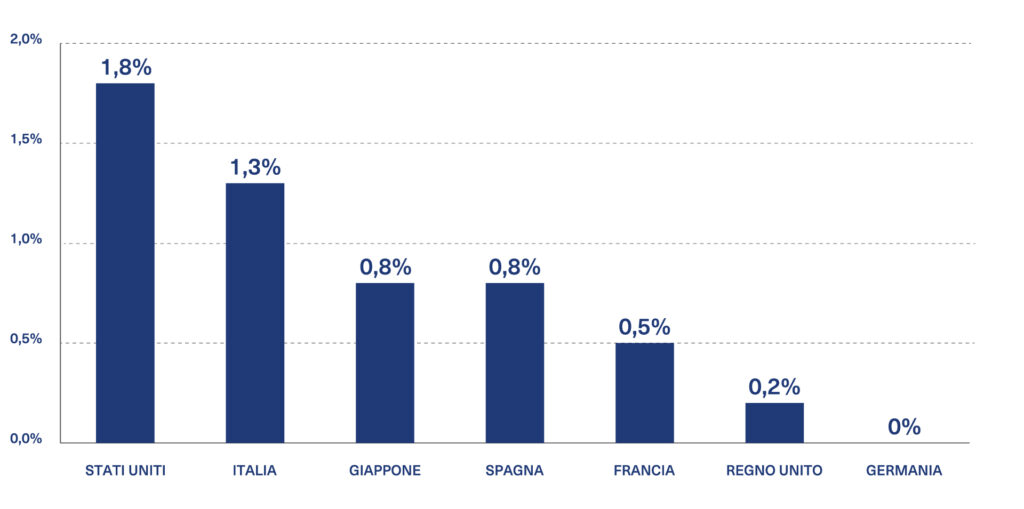

In fact, excluding the population boost from economic growth, Italy's GDP per capita was not only second in terms of increase only to that of the United States in 2020-2024 (+6.6 percent and +9.9 percent over 2019, respectively, with France standing still at +1.7 percent and Germany even declining by -1.5 percent), but it will even be slightly higher than that of the United States in 2025-2026 (+2.9 percent versus +2.8 percent), as well as that of all other countries. In terms of average annual growth, Italy (with +1.3 percent) will even be the only one, along with the United States (with +1.8 percent), that will realize an increase in its GDP per capita of more than 1 percent over the entire 2019-2026 period. In contrast, it will be all the other countries considered that will record “zero-point” growth: Spain and Japan (+0.8% average per year), France (+0.5%), the United Kingdom (+0.2%), and Germany (even 0%).

REAL AVERAGE ANNUAL GROWTH OF GDP PER CAPITA: 2020-2026

(% change compared to 2019)

Source: elaboration by M. Fortis on data and forecasts from the European Commission

Italy returns to primary surplus

According to the European Commission's data as well, Italy will return to a positive primary public balance (i.e., before interest payments) of 0.1 percent of GDP in 2024, the only G-7 country to achieve this. Not only this. The Italian state will be the only one to have a primary budget surplus in the two-year forecast period 2025-2026 as well, to be exact, a cumulative surplus of 37.4 billion euros, or 1.6 percentage points of GDP. In contrast, the other G-7 countries will still accumulate huge primary government deficits in 2025-2026: Germany -69.5 billion euros; the United Kingdom -72.5 billion pounds; France -160.2 billion euros; the United States -1,479 billion dollars; Japan -48 trillion yen (the Commission does not provide data for Canada).

CUMULATIVE PRIMARY STATE BUDGET IN 2025-2026

(States' budgets excluding interest expenditure, in billion euros)

Source: elaboration by M. Fortis on data from the European Commission

On a longer projection, then, already the International Monetary Fund's October “Fiscal Monitor” had certified that not only in the two-year period 2025-2026, but also in the three-year period 2027-2029, Italy will continue to be the only G-7 country able to present a positive primary state budget, along with Germany, which will, however, return to surplus only in 2027. Specifically, from 2027 to 2029 Italy will accumulate a primary state surplus of 3.2 percentage points of GDP, better than Germany itself (+1.5 percent) and significantly better than the other five G-7 countries, which will remain in deficit: Canada (-1.1 percent cumulative); the United Kingdom (-2.2 percent); the United States (-7.5 percent); Japan (-7.6 percent); and France (-9.1 percent).

The reality is that Italy can boast an extraordinary past and future history of primary government surpluses. In fact, from 1995 to 2029 (also considering the European Commission and IMF forecasts), that is, in 35 years, ours will be the only country in the G-7 and the EU capable of presenting a primary state budget surplus for a total of no less than 30 years, with the exception of only 2009 (global financial crisis) and the four-year period 2020-2023 (pandemic and post-pandemic years). For historical comparison, over the same period (1995-2029) France will be in primary surplus for only 4 years (the last was in 2001), the United States for 9 years (the last in 2007), Spain for 11 years (the last in 2007), and Germany for 19 years.

NUMBER OF YEARS IN WHICH THE G-6 COUNTRIES HAD

POSITIVE PRIMARY BALANCES: 1995 - 2029

Source: elaboration by M. Fortis on data and forecasts European Commission and IMF

Regarding more recent years, it should also be noted that Italy, along with Germany, will turn out in the Covid period and the following years until 2026 to be the country whose debt-to-GDP ratio will have increased the least. In fact, Italy's debt will mark +5.7 percentage points of GDP over 2019; Germany's +4.2 percent. But with one key difference: compared to 2019, Germany's GDP in 2026 will turn out to have grown much less than ours, as mentioned earlier. All other G-7 countries in 2020-2026 will meanwhile see their debt-to-GDP ratios rise dramatically (compared to 2019): Japan +13.5 percent; the United Kingdom +17.5 percent; France +19 percent; the United States +20 percent.

In monetary value, Italy's public debt was the third largest in the G-7 before the pandemic, after the gigantic ones of the United States and Japan. In 2020, however, our debt was surpassed by France's and in 2021 also by the UK's and is now only the fifth largest debt in the G-7 in absolute value.

Another key aspect, which is often overlooked by commentators, is the growth of public debt net of interest, (i.e., “new” debt from primary budgets and annual stock-flow adjustments), an indicator in which Italy is particularly virtuous. In 2026, Italy's debt (already including the impact of stock-flow adjustments that will incorporate the aftermath of the building superbonuses in the last period) will be about 260 billion euros higher than in 2019, net of interest expenditure. This certainly does not cheer us, because this increase was mainly due to several costly economic policy mistakes in recent years that should and could have been avoided (citizenship income, “quota 100”, missed spending caps and controls on construction superbonuses). However, France's similar increase, for comparison, will be as much as 827 billion, which is more than three times higher than ours. And the increases in value of the “new” debts of the United States, the United Kingdom and Japan will also be enormous.

The reality is that, since we stopped the forced austerity imposed on us by Brussels (which increased rather than decreased the debt-to-GDP ratio), with the Renzi and Gentiloni governments our public debt has finally dropped (from 134.7 to 133.6). Then it remained essentially stable in the 2018-2019 biennium. Finally, data and the latest projections from the European Commission tell us that over the very difficult 2020-2026 timeframe (shaken by pandemics and wars) Italy is the G-7 country whose debt-to-GDP ratio excluding interest will turn out to have grown the least compared to the pre-Covid situation in 2019: only +1.8 points of GDP (already incorporating the deferred costs of building superbonuses). Italy will do better than even Germany (+2.9 points), while the debts net of interest of the United Kingdom (+9.2 points), the United States (+10.6 points), Japan (+10.8) and France (+12.9 points) will skyrocket.

Ultimately, in an increasingly debt-ridden world, Italy has made and is making far less debt than others in recent years and has returned to growth. Moreover, it is now a net creditor country on foreign countries. Even the rating agencies, which have never been tender toward us, are perhaps noticing this, although not yet all of them and with due awareness.